Training 2000 Limited Retirement and Death Benefit Scheme Implementation Statement

Year Ending 31 July 2022

Glossary

| ESG | Environmental, Social and Governance |

| Investment Adviser | First Actuarial LLP |

| LGIM | Legal & General Investment Management |

| Scheme | Training 2000 Limited Retirement and Death Benefit Scheme |

| Scheme Year | 1 August 2021 to 31 July 2022 |

| SIP | Statement of Investment Principles |

| UNPRI | United Nations Principles for Responsible Investment |

Introduction

The Trustees have reviewed the extent to which their policy relating to the exercise of rights (including voting rights) attaching to the investments was followed over the Scheme Year and this statement confirms the outcome of that review.

In addition, the statement summarises the voting record of the Scheme’s investment managers and provides information on the significant votes made in respect of the Trustees’ equity holdings. Information is also provided on how the Scheme’s investment managers make use of the services of proxy voting advisers.

Relevant Investments

The Scheme’s assets are invested in pooled funds and some of those funds include an allocation to equities. Where equities are held, the investment manager has the entitlement to vote.

At the end of the Scheme Year, the Scheme invested in the following funds which included an allocation to equities:

- Baillie Gifford Multi-Asset Growth Fund

- LGIM Future World Global Equity Index Fund

- LGIM Future World Global Equity Index Fund – GBP Currency hedged

The Trustees’ Policy Relating to the Exercise of Rights

Summary of the Policy

The Trustees’ policy in relation to the exercise of rights (including voting rights) attaching to the investments is set out in the SIP. The SIP was updated during the Scheme year to reflect changes made to the Scheme’s investment strategy, but wording relating to the exercise of rights was not revised. A summary of this wording is as follows:

- The Trustees believe that good stewardship can help create, and preserve, value for companies and markets as a whole and the Trustees wish to encourage best practice in terms of stewardship.

- The Trustees invest in pooled investment vehicles and therefore accept that ongoing engagement with the underlying companies (including the exercise of voting rights) will be determined by the investment managers’ own policies on such matters.

- When selecting a pooled fund, the Trustees consider, amongst other things, the investment manager’s policy in relation to the exercise of the rights (including voting rights) attaching to the investments held within the pooled fund.

- When considering the ongoing suitability of an investment manager, the Trustees (in conjunction with their Investment Adviser) will take account of any particular characteristics of that manager’s engagement policy that are deemed to be financially material.

- The Trustees will normally select investment managers who are signatories to the UNPRI.

- If it is identified that a fund’s investment manager is not engaging with companies the Trustees may look to replace that fund. However, in the first instance, the Trustees would normally expect their Investment Adviser to raise the Trustees’ concerns with the investment manager.

Has the Policy Been Followed During the Scheme Year?

The Trustees’ opinion is that their policy relating to the exercise of rights (including voting rights) attaching to the investments has been followed during the Scheme Year. In reaching this conclusion, the following points were taken into consideration:

- There has been no change to the Trustees’ belief regarding the importance of good stewardship.

- The Scheme’s invested assets remained invested in pooled funds over the period.

- During the Scheme Year, the Trustees introduced an allocation to the Insight Longer Real and Insight Longer Nominal funds. The Trustees considered the ESG characteristics of the fund before selecting it but, because the fund does not include an allocation to equities consideration of the exercise of voting rights was not relevant.

- In addition, during the Scheme Year, the Trustees introduced an allocation to the LGIM FW Global Equity Index Fund and the LGIM FW Global Equity Index Fund – GBP Currency hedged. The Trustees considered the ESG characteristics of the funds before selecting them and this included consideration of the investment manager’s approach towards the exercise of voting rights.

- During the Scheme Year, the Trustees considered the voting records of the Scheme’s investment managers over the period ending 30 June 2021.

- Since the end of the Scheme Year, an updated analysis of the voting records of the investment managers based on the period ending 30 June 2022* has been undertaken as part of the work required to prepare this Implementation Statement. A summary of the key findings from that analysis is provided below.

- The investment managers used by the Scheme are UNPRI signatories.

*Note the voting analysis was over the year ending 30 June 2022 because this was the most recent data available at the time of preparing this statement. The Trustees are satisfied that the analysis provides a fair representation of the investment managers’ voting approach over the Scheme Year.

The Investment Managers’ Voting Record

A summary of the investment managers’ voting records is shown in the table below.

| Investment Manager | Number of votes | Split of votes: for | Split of votes: Against / witheld | Split of votes: Did not vote / abstained |

|---|---|---|---|---|

| Baillie Gifford | 19,000 | 91% | 4% | 5% |

| LGIM | 140,000 | 76% | 23% | 1% |

Notes

These voting statistics are based on each manager’s full voting record over the 12 months to 30 June 2022 rather than votes related solely to the funds held by the Scheme.

Use of Proxy Voting Advisers

| Investment Manager | Who is thier proxy voting adviser? | How is the proxy voting adviser used? |

|---|---|---|

| Baillie Gifford | No proxy Voting Adviser | All done in-house, Manager aims to participate in all votes |

| LGIM | ISS and IVIS | ISS ans IVIS provide research and ISS administer votes. However, all voting is determined by guidelines set by LGIM. |

The Investment Managers’ Voting Behaviour

The Trustees have reviewed the voting behaviour of the investment managers by considering the following:

- broad statistics of their voting records such as the percentage of votes cast for and against the recommendations of boards of Directors (i.e. “with management” or “against management”);

- the votes they cast in the year to 30 June 2022 on the most contested proposals in nine categories across the UK, the US and Europe;

- the investment managers’ policies and statements on the subjects of stewardship, corporate governance and voting.

The Trustees have also compared the voting behaviour of the investment managers with their peers over the same period.

The Trustees’ key observations are set out below.

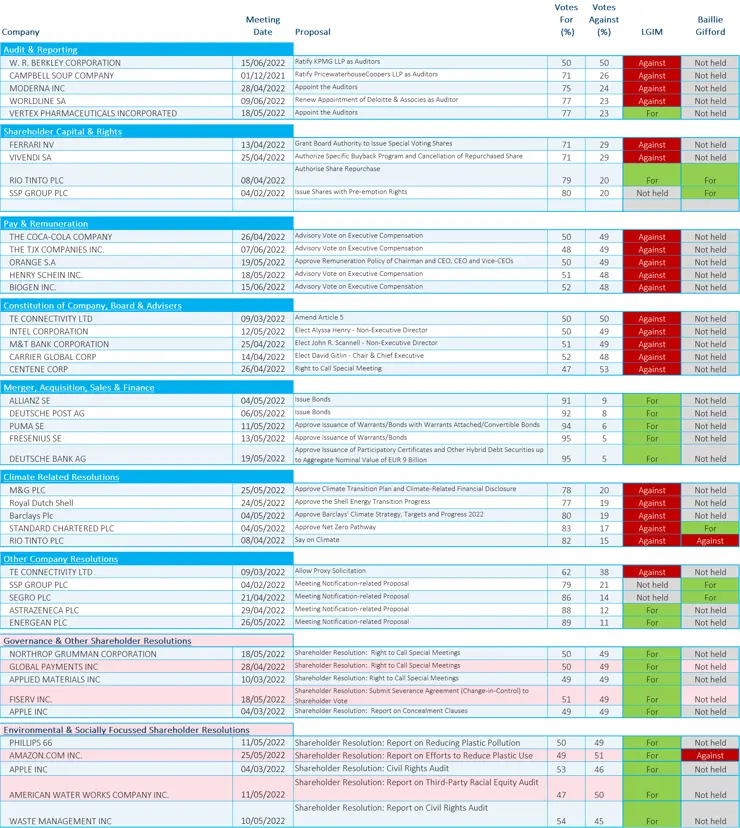

Voting in Significant Votes

Based on information provided by the Trustees’ Investment Adviser, the Trustees have identified significant votes in nine separate categories. The Trustees consider votes to be more significant if they are closely contested. i.e. close to a 50:50 split for and against. A closely contested vote indicates that shareholders considered the matter to be significant enough that it should not be simply “waved through”. In addition, in such a situation, the vote of an individual investment manager is likely to be more important in the context of the overall result.

The five most significant votes in each of the nine categories based on shares held by the Scheme’s investment managers are listed in the Appendix. In addition, the Trustees considered each investment manager’s overall voting record in significant votes (i.e. votes across all stocks not just the stocks held within the funds used by the Scheme).

Analysis of Voting Behaviour

Baillie Gifford

The Trustees have no material concerns regarding the voting record of Baillie Gifford.

The manager has a tendency to support management proposals. Baillie Gifford’s active management style provides some justification for this; it supports the management of companies it has actively chosen to invest in. However, in the context of poor share price performance, Baillie Gifford has more recently been less supportive of high executive pay.

Baillie Gifford has held companies to account on climate change issues. The investment manager opposed Director proposals on climate change which were deemed to not go far enough and supported shareholder proposals in this area.

Whilst there are also signs that Baillie Gifford is being more supportive of shareholder proposals aimed at tackling social issues, their lack of a support for a proposal looking to find out how plastic use by Amazon can be reduced will disappoint some. A message the Trustees’ Investment Advisors have fed back to Baillie Gifford.

LGIM

The Trustees have no concerns regarding the voting record of LGIM.

The manager’s willingness to vote against management is consistent with the broad range of policies covered within its corporate governance documentation; each policy provides a set of criteria which can be used to justify a vote against management.

The Trustees also note that LGIM has supported shareholder proposals designed to tackle ESG issues and has held Directors to account regarding their energy transition proposals (proposals setting out how greenhouse gas emissions will be reduced).

Conclusion

Based on the analysis undertaken, the Trustees have no material concerns regarding the voting records of Baillie Gifford or LGIM.

The Trustees will keep the voting actions of the investment managers under review.

Signed: Lisa Bloomfield

Date: 14 February 2023

Signed on behalf of the Trustees of the Training 2000 Limited Retirement and Death Benefit Scheme

Significant Votes

The table below records how the Scheme’s investment managers voted in the most significant votes identified by the Trustees.

Note

Where the voting record has not been provided at the fund level, we rely on periodic information provided by investment managers to identify the stocks held. This means it is possible that some of the votes listed above may relate to companies that were not held within the Scheme’s pooled funds at the date of the vote. Equally, it is possible that there are votes not included above which relate to companies that were held within the Scheme’s pooled funds at the date of the vote.